Employee Benefits

Sabir Bacus

Senior Benefit Consultant

Group Life Assurance (GLA)

An insured Group Life Assurance (GLA) policy is a form of insurance which provides independent life cover (death benefits) to individuals within a group of people. This group is almost always made up of employees of a particular employer (via an employer owned policy) or members of a particular retirement fund (via a fund owned policy). The life cover is insured with a registered insurance company. If an insured employee or a member of a retirement fund dies, the insured benefit is paid out, usually as a lump sum, to the employee’s or member’s beneficiaries, respectively.

The level of cover is usually determined by the employer and may be constructed in different ways. The most common basis of determining cover is as a multiple of annual salary, or as a fixed amount in rands.

There are two important differences between an employer owned policy and a GLA policy under a retirement fund: vis-a-vis tax, and the determination of beneficiaries.

Unapproved benefit

The benefits from the employer owned policy are paid out tax-free to beneficiaries. The monthly contributions paid by the employer are taxed as a fringe benefit. Within the employee benefits business, this is often referred to as an “unapproved benefit”.

The proceeds of an unapproved benefit form part of the estate of the deceased employee and will be subject to estate duty. Any amount paid to the spouse of the deceased employee will be deducted from the estate before estate duty is calculated.

Approved benefit

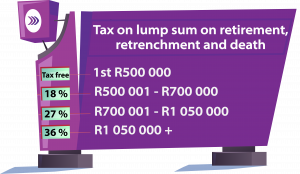

In contrast to an unapproved scheme, a lump sum payable under the “fund owned policy”, is taxed, while the premiums paid for the cover are deductible – exactly the opposite of the “unapproved benefit scheme”. This fund death benefit is referred to as an “approved benefit” and is taxed in accordance with the tax table below, with a certain amount tax-free.

An approved benefit does not form part of a deceased member’s estate. For this reason, the proceeds of an approved benefit are not subject to estate duty. If the benefit is paid into the deceased’s estate (because there are no beneficiaries), the executor must exclude the benefit from the dutiable portion of the estate.

A retirement fund member must therefore be knowledgeable as to whether their GLA is approved or unapproved and understand the importance of nominating a beneficiary. For example, cover of five times an annual salary of R800 000 is R4 million. If this is unapproved, beneficiaries would receive R4 million (estate dutiable @20% if not payable to the spouse, thus a possible tax payable of R800 000), however if it is approved, they will receive R2 807 500 – a difference of some R1 192 500 (provided that the full tax-free amount of R500 000 is still available as a deduction).

Fund owned policy

The beneficiaries under the “fund owned policy” are determined by legislation (the Pension Funds Act) and supported by court judgements and Pension Fund Adjudicator decisions. In short, the Board of Trustees of a retirement fund is responsible for determining the beneficiaries, the amount to be paid to each beneficiary and the mode of payment. Completing a beneficiary nomination form is important as it reflects a member’s wishes and forms the primary guide for the distribution of a fund death benefit.

This aspect of pensions law will be covered in a future article as it is substantial, material, and far reaching.

The insurer offering GLA cover will conventionally offer most insured employees or members, cover without them having to produce medical evidence. The insurer sets a medical-free cover limit (MFCL) and to the extent that the cover of an individual is below the MFCL, they (the insured) will be covered without conducting any medical tests. Cover above the MFCL will require medical underwriting.

As with all insurance, there are terms and conditions that apply, an example being the exclusion of war and riot cover.

Together with these core death benefits, supplementary insured benefits may also be provided, such as, an education protector benefit for the insured children, spouse’s and children’s pension, accident benefit, spouses’ death benefit and burial repatriation, to name a few. These will be covered in future articles.

Upon resignation or retirement from the participating employer, many GLA’s offer a conversion option. An employee or member who was insured, may convert this benefit into an individual policy with the insurer, taking over this cover in their own name, with limited medical underwriting. This is often an important opportunity for older members who could otherwise find passing the extensive medical underwriting difficult, or impossible, and who would probably have increased premiums based on their own medical test results. As with all financial planning, there are many terms, conditions and specific circumstances that need to be considered when making decisions in this regard.

In most instances, the provision of GLA cover to members and employees:

- Is cost effective, as the risk is spread over the entire membership, often attracting much lower premiums than would be applicable on an individual basis.

- Allows for benefits for all by usually offering a MFCL.

- Attracts favourable tax treatment on pay out, either allowing up to the first R500 000 (if not depleted for example by a prior retrenchment) on fund death benefits, or the whole amount on an employer owned policy, to be tax free.

As has been illustrated, the benefits and tax consequences of life insurance associated with a retirement fund (and indeed all other aspects of a fund), are complex with significant financial consequences for members. It is strongly recommended that employers and fund members engage the services of professionally qualified benefits consultants to unpack these benefits and ensure that they are optimally structured.

GTC has an experienced team of benefit consultants and financial advisors on hand to provide this advice.