Market Update – June 2014

Global Global equity markets continued their upward trend with the MSCI World posting 1.7 %(USD) mainly on the back of strong US(2.1% USD) and Japanese(5.2% USD) gains with Europe flat(-0.1% USD). EM markets also benefitted from the risk on environment, posting 2.0% (USD) while global fixed income markets returned 0.4%(USD) in June. In the U.S.A. the Bureau of Economic Analysis announced a final negative 2.9% decline in GDP for the first quarter of 2014 which came as a shock following the positive 2.6% growth in GDP the previous quarter. Read the full article GTC Fund Performances The GTC High Equity Funds (previously Aggressive) continues to deliver outperformance relative to the inflation adjusted target. Over the past 12 months, the main contributors to performance have been the equity market and offshore allocation. 2014 has seen a reversal of last year’s trend... Read More

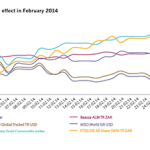

Market Update – February 2014

Budget 2014/2015 Apart from Minister Pravin Gordhan’s budget speech, February brought with it interesting and counter intuitive developments both in the local equity and bond markets. The 2014 Budget focuses on interventions that are aimed at placing the economy on a new growth trajectory. Government’s primary objective is to raise real economic growth to between 5 and 6 percent per annum. This higher level of economic growth should boost state revenue and enable the government to increase expenditure on improving peoples’ lives by dealing with the high levels of unemployment, poverty and inequality. Read the full article The Rand shock absorber effect U.S.Federal Reserve chair Janet Yellen suggested before the Senate banking committee that the pace of the Fed’s economic stimulus plan tapering could be slowed if weakness in the American economy continued. Wall Street rallied as a result with the... Read More

GTC Trendline – September 2014

The ghost of irrational exuberance? Global Perhaps the ghost of irrational exuberance came back to haunt some world stock markets during the third quarter of 2014. The quarter has seen considerable volatility in world markets heralded by a rampant dollar on the back of strong economic growth, a weaker Euro on the back of renewed tensions in the Russia/Ukraine standoff, concerns over the sustainability of economic growth in China and a downgrading of Emerging Markets on concerns over commodity pricing. Read the full article. Who put the lights out? Domestic Despite disappointing economic data and ongoing labour unrest, the local stock market continued its meteoric rise over the quarter with the FTSE/JSE ALSI reaching an all-time high on the 29th July of 52,323. This stellar performance was largely influenced by carry trades in which foreign investors are able to source... Read More

GTC Trendline – March 2014

Salient Points from the Budget Speech “So the new economic order we seek cannot just be a pact amongst elites, a coalition amongst stakeholders with vested interests. Nor can it be built on populist slogans or unrealistic promises. Our history tells us that progress has to be built on a vision and strategy shared by leaders and the people- A vision founded on realism and evidence” – Pravin Gordhan, Budget Speech 2014. This philosophy espoused in the preamble to this year’s budget signalled the intention of the fiscus to address once again the serious problem of the gross inequality within the South African economy. It heralded a budget, which while fairly mundane, was nevertheless squarely directed to benefit the less fortunate in our population. Read the full article Market Commentary The quarter was characterized by a market roller coaster ride alternating... Read More

GTC Trendline – December 2013

Seeing the wood for the trees 2013 will be a year potentially remembered by investors as a significant inflection point regarding investment market forces. When the dust and commentary have settled on the year, certain dominating influences including the United States and politically driven financial repression will remain. The biggest story of the quarter, and indeed of the year was the announcement of the starting date for the much feared taper. The Federal Reserve (Fed) announced that it would finally begin reducing the amount of securities purchased by $10 billion per month to $75 billion from January 2014. Market reaction to the announcement in December was mild in comparison to the “taper tantrum” experienced in May. Read the full article GTC Fund Performances The GTC Fixed Income Fund has continued to deliver strong returns relative to cash over all periods as well... Read More

GTC Trendline – September 2013

Credit growth surprises market The growth of 1.6% (R39bn) in private sector credit during the month of August surprised market economists as the previous recording was a decline of 0.3% (R7bn) in July 2013. On an annual basis, private sector credit grew by 8.2% whilst the market expected just 7.2%. The major contributors were the increases in corporate credit which grew by over R30bn month on month and a renewed mortgage sector which added around R7bn to credit growth extension. This is the highest growth in mortgage loans since 2010. The mortgage sector credit growth shows consumers have returned to the local property market but the levels of credit extension are still restrained relative to the heydays between 2005 and 2008. Over the past 12 month mortgage credit has risen by a total of just over R22bn, which is still... Read More

GTC Trendline – June 2013

Markets react to SA’s weak outlook A slew of economic data released in June 2013 showed South Africa as moving deeper into economic weakness following a slower than expected growth outlook while imports have continued to exceed exports. The trade deficit account has remained in negative territory for the past 17 months and the year to date deficit stands at R68.7bn, compared to the R46.2bn deficit for the first five months in 2012. Read the full article GTC fund performances The GTC Fixed Income Fund has continued to deliver strong returns relative to cash and managed to outperform the short end of the bond market. The manager has increased duration in the fund to benefit from the improving yields, which have contributed to performance. The manager has also increased exposure to credit instruments which offer higher yields than the... Read More

GTC Trendline – March 2013

Equity market jitters but ALSI delivers positive return The month of March revealed the fragility of the local equity market as investors faced continued pressure in holding equities. Although the industrial sector regained earlier losses, the sentiment changed mid-month, whereupon retail stock holders, in particular, decided to offload these into the marketplace. At the same time, South Africans saw the Rand weaken against all major currencies. Read the full article GTC fund performances The GTC Fixed Income Fund has produced returns in excess of cash over all annualised periods. Despite the low cash rate environment, the manager has used various yield enhancing strategies such as credit and duration to improve the fund performance. Although interest rates are unlikely to increase this year, the next move is likely to be higher, which will enhance the overall return for investors looking for... Read More