Wealth Management

Jenny Williams

Senior Servicing Consultant

_______________________________________________________

Considerations of a long-term well-structured retirement portfolio – Part 1

Whilst it is the fifth and last article in our current series on family financial planning, this topic of retirement from investment products is complex and particularly important. Accordingly, we are splitting this article into three sections over the next several Trendline editions. These will cover retirement from compulsory and discretionary investments, followed by investment portfolios available for pre- and post-retirement, and lastly the annuity options available on retirement.

To kick off this mini-series, we will focus on retirement from compulsory and discretionary investments.

In a recent Trendline, we defined what compulsory investments are, namely investments that are registered under the Pension Funds Act, and upon which tax concessions are granted, either on contributions, investments within the product, or upon the maturity benefits. Such products as pension and provident funds, as well as retirement annuities, fall within this category.

Until an investor has a working knowledge of South Africa’s retirement products -and their tax consequences (through tax deductions allowable on contributions, or the investments within the product, or on the benefit at maturity) – they cannot be expected to compile a functional family financial plan with any degree of completeness.

Until an investor has a working knowledge of South Africa’s retirement products -and their tax consequences (through tax deductions allowable on contributions, or the investments within the product, or on the benefit at maturity) – they cannot be expected to compile a functional family financial plan with any degree of completeness.

Retirement age

When an investor reaches the government’s defined retirement age – which may differ from the rules of a particular company-sponsored retirement fund – compulsory and discretionary investments are likely to simultaneously reach their pre-determined maturity dates. Investors (often also policyholders, if they have used approved life insurance products such as retirement annuities as their investment product) will be faced with decisions regarding the pay-out of maturity values and the ongoing structure of investment portfolio’s – which for compulsory investments must provide an income for the rest of their life.

Options available at retirement

Compulsory investments: pension, provident, and retirement annuity funds

Upon retirement from:

- a pension or retirement annuity fund, a cash lump sum amount of up to 1/3rd of the maturity benefit may be elected, unless the benefit value is less than R247 500, in which case the whole benefit is available as a cash lump sum.

- a provident fund, the full benefit is available as a cash lump sum, though T-Day rules do apply.

Even though the consideration is probably still a year away, further complexity is being introduced with the Two-Pot system.

Tax on cash lump sums from retirement funds

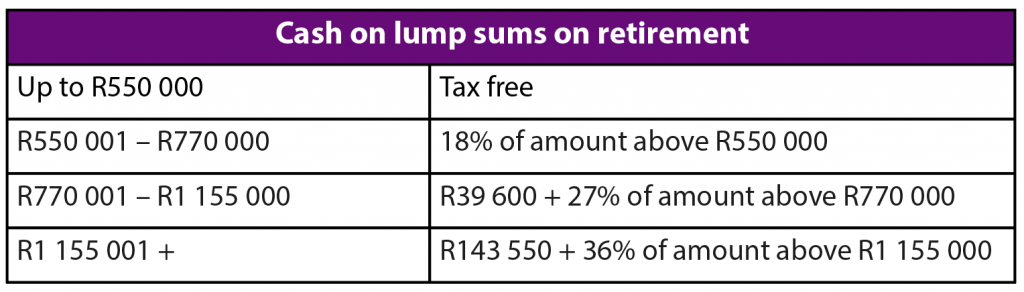

Specific tax is applied by SARS as per the table below when a cash lump sum is selected at retirement.

T’s and C’s apply. Use this only for illustrative purposes.

The tax-free threshold reflected on line one of the table is cumulative. All lump sums paid in cash over a working lifetime, commencing on or after 1 March 2009, will be taken into consideration by SARS and included in line one, including any previous cash lump sum retirement benefits received from all other approved retirement funds.

When assisting upcoming retirees with the decision about how much of the maturity value to take as a cash lump sum on retirement, the GTC MAPS (Member Advice Portal Support) team will provide guidance, taking the following, often overlooked, critical factors into account:

- Any previous benefits, including cash withdrawals or retrenchment benefits, will – for purposes of the tax calculation – be added to the current lump sum amount to determine the tax payable. This creates an overlap between the ‘pre-retirement exit lump sum tax table” and the ‘retirement lump sum tax table’. The addition of these previous amounts yields a greater value than the current cash benefit amount being considered. This may result in a higher rate of tax being applied to lump sums on retirement if the addition of these previous amounts increases the value enough to require that a higher tax rate – per the table – is used.

- Without this knowledge and the realisation that previous exit values are cumulative, the investor often forfeits the opportunity to consider amending the amount of the lump sum being considered, to limit the tax payable, often resulting in a larger tax bill than anticipated payable to SARS and a lower after-tax amount paid out to the member, than expected.

- There are different income tax implications on lump sums as compared to income from the annuity. The tax implications should play a big part when considering what portion of the possible 1/3 to elect as a cash lump sum versus taking that same apportionment and purchasing an annuity income. In other words, is the marginal rate of tax on the income produced by the annuity higher than the tax that would have been paid on the lump sum, using the retirement tax table?

-

GTC’s wealth managers make use of GTC’s powerful proprietary financial planning software TrueNorth when establishing a financial plan for a client. TrueNorth’s actuarial calculations include these intricacies and are used to assist retirees with these complicated calculations to ensure a better understanding of their options and to make informed decisions at retirement.

- Liquidity – once the money has been transferred into an annuity all future options for lump sum cash withdrawals fall away.

You may also defer your retirement to a later more suitable date.

Deferred retirement (pension and provident funds)

In terms of recent changes in legislation policyholders and fund, members are no longer forced to utilise maturity benefits immediately upon reaching their predetermined retirement age. The payout of benefits may be deferred until such time as the benefit is needed.

Transfer to a retirement annuity fund or a preservation fund (full benefit to be transferred)

In terms of current legislation, transfer to a retirement annuity or preservation fund is allowed, along with the deferment of the benefit until such time as income is required, with no negative tax consequences. These options were previously reserved for pre-retirement exits only.

Annuity (pension) options

Annuity options for both compulsory and discretionary investments will be covered in a future edition. Suffice to say, there are various types of annuities to be considered. For compulsory investments, bar the ‘de minimis’ rule, the income provided by the annuity must continue for the rest of a member’s life.

For discretionary investments, the use of a voluntary annuity to provide ongoing income comes with favourable tax consequences on income generation and must form part of the considerations when completing your financial planning.

Remember the ‘de minimis’ rule whereby if the benefit is less than R247 500 then the whole benefit can be taken in cash (subject to the retirement tax table).

Investment portfolios

Members are often unaware of their option to select underlying investment portfolios for their pre- and post-retirement products.

The use of inefficient and non-performing underlying investment portfolios can have a considerably detrimental effect on retirement provision and therefore deserves as much attention as the consideration for saving in the first place.

GTC will unpack these intricacies in a future edition of The Trendline.

To ensure that you are on the right path to a successful and meaningful retirement, speak with one of the advisors within the MAPS team.

Contact our GTC MAPS team or your GTC Financial Adviser, for more information on this complex topic.