Market Overview

In-depth market commentary detailing market performance over the quarter

Market volatility – More of the same

Market performance over quarter one (Q1) was deceptively upbeat given that most asset classes posted positive returns. In reality, these positive returns did not accurately reflect the volatility underlying the return journey. Significant headwinds persist which cloud the hope for a strong global economic recovery in 2023. Demand for safe-haven asset classes remained strong as investors became increasingly troubled by global economic growth prospects. All this necessitates continued caution in portfolio positioning.

Market performance over quarter one (Q1) was deceptively upbeat given that most asset classes posted positive returns. In reality, these positive returns did not accurately reflect the volatility underlying the return journey. Significant headwinds persist which cloud the hope for a strong global economic recovery in 2023. Demand for safe-haven asset classes remained strong as investors became increasingly troubled by global economic growth prospects. All this necessitates continued caution in portfolio positioning.

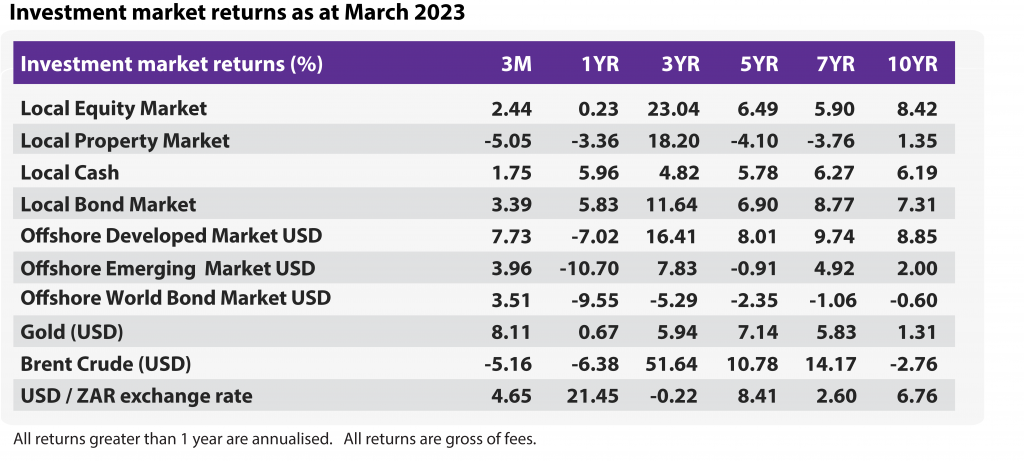

Over the quarter:

- Local equities sold off over the month of March 2023 amid worries around what the impact of the international banking sector sell-off would mean for local banks. Notwithstanding this concern, local equity markets ended the quarter up +2.4% as enthusiasm around China’s increased participation in global trade – following self-imposed lockdown restrictions in 2022 – excited markets early in the year. On the back of this euphoria, the local industrials sector rallied +13.6% buoyed by the +10% & +12% returns from Naspers and Prosus respectively over the quarter.

- The local resource sector shed -4.4% amid output-linked concerns surrounding Eskom and Transnet’s operating ability. Local property retracted by -5.1% while financials ended the quarter flat at +0.4% after losing 5.8% in March amid the international banking sector sell-off.

- International equity markets had a strong quarter with developed markets earning +7.7% and emerging markets +4.0% in US dollar terms. The US dollar strengthened by +4.7% relative to the ZAR which further provided a tailwind for offshore assets’ return over the quarter.

- Over the quarter. the South African Reserve Bank (SARB) raised interest rates twice totaling 0.75% taking the repo rate to 7.75%. This represents an overall 3.75% interest rate hike since the start of 2022 in their efforts to reduce inflation.

- South African headline inflation (CPI), which peaked in July 2022 at 7.8%, subsequently slowed to 7.0% in February. While this level remains above the top end of the SARB’s target range (3% – 6%), it provided some comfort that inflation is likely topping off and not increasing further.

- On a similar note, US headline inflation came in at 5% for the year ended February 2023 while the European Central Bank (ECB) continue to battle CPI at 9.9%. In response to elevated inflation the US FED hiked interest rates by 0.5% to 5.00% over the three months while the ECB increased rates by a total of 1.00% to 3.50%.

- The local bond market (ALBI) delivered +3.4% for the quarter ahead of local cash (STEFI) at +1.8%.

- Overall, investor sentiment improved slightly as the hunt for yield increased over the quarter. Some reprieve was found in the global bond markets which ended the quarter up +3.5% in US dollar terms. However, the quarter’s rally was not enough to off-set the deep negative return experienced in the preceding 9 months as the 1-year return remains in the red (-9.6% in dollar terms).

Considerable market volatility and economic uncertainty remain persistent with overall subdued global trade expectations and global recessionary fears. Increasingly restrictive monetary policies from global central banks – given their concerns around longer-lasting inflation – have kept markets in some turmoil since the start of 2022.

Amid the challenging global backdrop GTC remains cautious in our portfolio positioning as we navigate through this market cycle. GTC has always maintained that remaining invested, in line with one’s investment objectives, is a key component in achieving one’s financial goals.