Market Overview – First quarter 2024

In-depth market commentary – All that glitters may be gold…

The global investment market backdrop remains mired with uncertainty as we end the first quarter of 2024 and will likely persist for the remainder of the year. Conflicting economic data with structurally higher inflation has necessitated that restrictive monetary policies stay in effect. As previously communicated, heightened risk factors require continued caution in portfolio positioning.

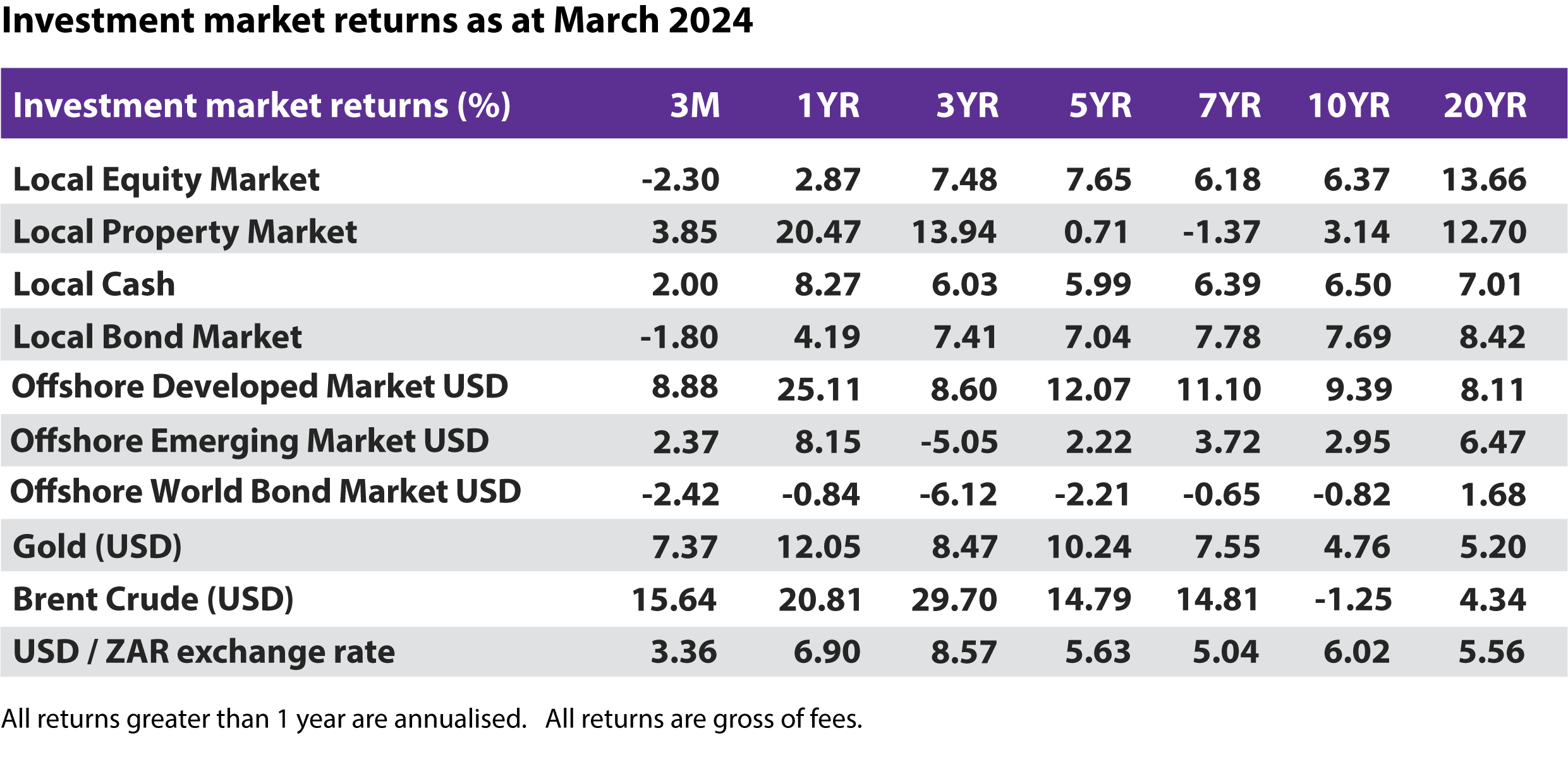

Over the quarter:

- Global developed market equities rallied +8.8%, well ahead of emerging market equities of +2.4% in U.S. dollar terms. The dollar strengthened +3.4% relative to the rand, further providing a tailwind to offshore assets’ rand-based returns over the quarter.

- Despite a strong March return, the local equity market remained negative over the quarter, pulled down by poor returns in January and February. The financials sector ended the quarter in the red (-7.1%), while the local property sector gained 3.9%, and the local Industrials +0.6%. Notwithstanding the +15.4% rally from the Resources sector in March, the sector was only marginally positive (+0.8%) for the quarter.

- Central banks across the world kept interest rates unchanged as they continued to battle with stubborn inflation. Interest rates remained at +8.25% in South Africa, +5.5% in the US, and +4.5% in the European Union at the end of March 2024.

- South African headline inflation (CPI) increased marginally to +5.6% in February 2024. While this level is within the SARB’s target range (3% – 6%), it by no means dissolves inflation concerns as global trade and energy challenges remain a headwind.

- US headline inflation came in at +3.2% in February 2024, while European Union inflation declined slightly to 2.4%.

- The local bond market (ALBI) shed 1.8% for the quarter, behind local cash (STEFI) at +2.0%. The Global Government Bond Index (WIGBI) experienced a -2.4% decline over the quarter as yields pushed up amid investor concerns.

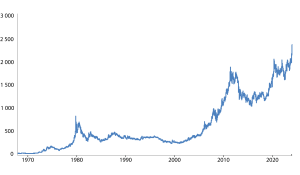

- After breaching the $2 000/ounce late in 2023, the Gold price has continued its upward trajectory to end the quarter at $2 240/ounce. The demand for this commodity is pervasive in a risk-off environment fueled by elevated geopolitical tension, global trade uncertainty, and investor concern. These forces along with supply chain disruptions, and production cuts by OPEC, has propelled the price of Brent Crude oil to $87.5/barrel at the end of the quarter.

- Overall, global investor sentiment was mixed over the quarter. While the short-term outlook is still unclear, the longer-term picture remains positive.

With more than 50 nations preparing for a national election or enduring the aftermath of one this year, coupled with the ongoing conflict in the northern hemisphere, uncertainty prevails within the global investment environment. Safe-haven assets tend to shine in this environment and gold’s glittering 7.4% bull-run over the quarter is no exception.

Gold price USD

Amid these global challenges, GTC remains cautious in our portfolio positioning as we navigate through this market cycle. GTC has always maintained that remaining invested, in line with one’s investment objectives, is a key component in achieving one’s financial goals.