Non-yielding assets can still be attractive

David Seligman Fund Manager _______________________________________________________________________________________________________ The allure of non-yielding assets: A look into alternative investments In the pursuit of financial growth, investors often favour traditional assets such as shares and bonds, drawn by their potential for regular income and anticipated long-term capital appreciation. Recent events in our volatile world however have shone a light on what can be termed ‘non-yielding assets’. This diverse category encompasses tangible stores of wealth such as gold, antiques, art, and fine wine, as well as intangible innovations such as cryptocurrencies. While these assets don’t generate the income streams that dividends and interest do, they hold a unique appeal, promising potential returns driven by appreciation, scarcity, and sometimes even passion. The allure of these sometimes emotional purchases is accompanied by its own set of pitfalls, demanding careful consideration before venturing into this... Read More

Retirement reality check: Are you prepared for 20 extra years?

Gary Mockler Group Chief Executive Officer _______________________________________________________________________________________________________ Do you know you may live 20 years longer than your parents did? Most South African companies have a retirement age of 65. If you work for a bank or similar financial institution, there’s every chance that retirement age is 60. On average, South African retirement funds have a gross contribution (from both the company and the employee) of some 16% according to the annual Sanlam survey. Remembering that costs and insurance are deducted from this gross amount, the net percentage of payroll allocated to retirement funding is just over 14%. While retirement funds, stipulated retirement ages, and retirement contributions have not substantially changed over the past 40 years, longevity statistics show that if you’re now 40, you could have a real expectation of living 20 years longer than your parents did. According... Read More

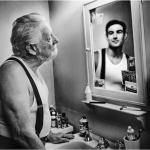

Financial advice I would give my twenty-year-old self

Reflecting on my journey from a modest childhood background to a comfortable retirement, here are key insights that I would give my younger self if he (or is it me?) was starting a financial journey now. Early beginnings and career Growing up in a large family (I was one of 10 children), financial stability wasn’t a given. I started my career with minimal income during military service, later qualifying as a Chartered Accountant. Marriage and children followed, prompting us to invest in a home, together with the conventional process of raising a family. Do you start with your head, or your heart? It’s all very well to pursue a prospective career based on ones prevailing interests. Choosing a qualification and career path that provide for realistic financial reward, rather than the idealistic pursuit of a life passion is a reality... Read More

Market Overview – Fourth quarter 2024

In-depth market commentary – making sense of a shifting landscape Over the quarter: Local equities ended the quarter -2.14% in the red pulling down the 2024 full-year return to +13.4%. The Financials sector declined -1.8%, while Industrials posted a modest gain of +0.2% over the 3 months. The Resources sector was the largest detractor, down -10.1% over the quarter and -7.2% over the year. The local property sector shed -0.8% for the quarter, though its performance for the year remained strong at +29.0%, making it the best-performing local asset class of the year. The South African Reserve Bank (SARB) continued its rate-cutting cycle during the quarter, reducing the repo rate by 25 basis points to 7.75%, a move that was largely in line with market expectations. The South African Chamber of Commerce and Industry (SACCI) Business Confidence Index (BCI) rose... Read More

CEO editorial – Quarter 4 2024

Gary Mockler Group Chief Executive Officer _______________________________________________________________________________________________________ Several interactions with GTC clients over the past few months prompts me to write this. By now you’ll be familiar with my requirement that every article posted in the Trendline should meet the definition of ‘advice’. Any reader of any article should walk away from this exercise with at least a reminder as to how to go about some aspect of their financial planning. Two of the examples of client engagements that I have recently been through, emanate from clients questioning whether they have received accurate and professional advice. I write this not in defense, but rather in the realisation that instances such as this will occur again in the future. In the first instance, a long-standing client with a long-standing relationship with the GTC team had a living annuity that nominated his... Read More