Buying vs. renting in South Africa

Manty Seligman

Manty Seligman

Director – Asset Management

_______________________________________________________________________________________________________

Navigating property decisions in South Africa’s high-interest rate climate 2025

In the unpredictable theatre of South Africa’s economy, the age-old question resurfaces with fresh urgency: Is now the time to buy a home, or does renting offer a smarter play?

In the unpredictable theatre of South Africa’s economy, the age-old question resurfaces with fresh urgency: Is now the time to buy a home, or does renting offer a smarter play?

The appeal of homeownership is enduring – equity, stability, pride of place. But when interest rates flirt with 12% and the broader macroeconomic outlook feels like a game of political Jenga, even seasoned investors are pausing to reassess. The answer isn’t as binary as it once was.

The economic landscape: Debt is no longer cheap

As of 2025, the South African Reserve Bank is holding the line on elevated interest rates in a prolonged bid to manage inflation and stabilise a battered currency. Prime lending rates hover around 11.75% to 12.25%. That makes debt expensive – and long-term debt like a home loan, even more so.

Take a modest R1.5 million property. A 20-year bond at 12% pushes monthly repayments above R16,000. That figure is not only hefty – it often exceeds comparable rent in major metros. Suddenly, the romanticism of ;owning your own’ is met with the cold arithmetic of borrowing costs.

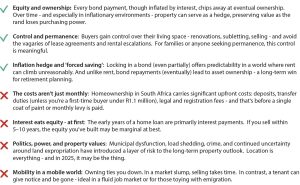

Buying property: The case for long-term thinking

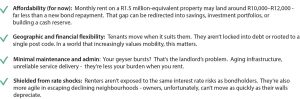

Renting: The case for flexibility and liquidity

The political overlay: When policy trumps property

In South Africa, political realities blur the clean lines of property economics.

Failing municipalities (see Johannesburg, eThekwini), load shedding, and unclear land reform policy all introduce volatility. A property in the wrong location – once seen as ‘aspirational’ – can become a liability as services crumble and residents flee.

That said, pockets of stability do exist. Many in the Western Cape, for instance, enjoy better governance, safer streets, and rising asset values – albeit at premium prices. The divergence between well-run metros and struggling ones continues to widen.

It’s not just about the money

There’s also life to consider:

- Young professionals, remote workers, and digital nomads often value freedom over fixed walls.

- Families may prioritise schooling, routine, and community – and thus lean toward ownership.

- Older investors might explore hybrid models like rent-to-own or buy-to-let arrangements to balance liquidity and capital growth.

Don’t just choose – Calculate

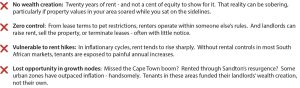

Buy if:

- You plan to stay in one place for 7–10+ years.

- You can handle a large deposit and still afford bond repayments.

- You’re buying in a growth node with stable governance.

- You value control over your living space and want to build equity.

Rent if:

- You’re not ready to settle, or plan to emigrate.

- You want to preserve liquidity and avoid interest-heavy debt.

- You prefer mobility and minimal maintenance.

- You’re wary of political or economic risks tied to property markets.

Agility may be the new asset class

In a high-cost, high-risk, high-uncertainty environment, flexibility is financial strategy. Renting may be the more prudent choice – for now. But for those who play the long game, buying in the right location, with the right time horizon, can still yield solid returns.

In the end, the best decision in 2025 isn’t about bricks or leases. It’s about understanding your goals, reading the market, and staying agile enough to pivot when reality changes – because it almost certainly will.