Your annuity IQ: Put it to the test

Do you know your annuity arse from your annuity elbow?

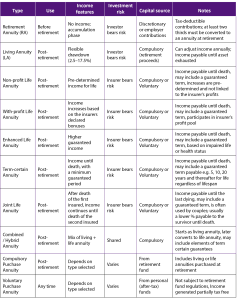

Or, more politely speaking, do you know your retirement annuities from your living annuities? When meeting a prospective financial planning client for the first time, the existence of an annuity (or a bunch of them) is often mentioned. It requires a reasonable amount of further investigation to understand the actual investment product being referred to. Within the South African financial planning context there are around ten different types of annuities available, some of them fundamentally different from the others.

While we at GTC keep reiterating that consultation with a professional financial planner is essential, it is also true that you, as the investor, there is a need to be as informed as possible as the final decision vests with you. It should never be that you are implementing any financial structure without a working knowledge of what you are doing.

If there was a quiz with each correct answer being worth one mark, what would your score be out of ten if asked to define each of the following different annuities?

- Retirement annuity

- Non-profit life annuity

- With-profit life annuity

- Enhanced life annuity

- Compulsory purchase annuity

- Voluntary purchase annuity

- Life annuity

- Living annuity

- Term-certain guaranteed annuity

- Hybrid annuity

Knowing that financial planning, and particularly financial planning jargon, is complex and that understanding the differences between these numerous different annuities, requires proper training and experience, an average investor would probably score very low on this hypothetical test.

Knowing that financial planning, and particularly financial planning jargon, is complex and that understanding the differences between these numerous different annuities, requires proper training and experience, an average investor would probably score very low on this hypothetical test.

Financial services technicians love converting financial terms and product names into TLA’s… (three letter acronyms). These TLA’s are often even lengthened into four and five letter acronyms. The South African financial landscape is littered with them, FSCA, ASISA, AVC’s, TIC’s, BPS, etc. If you really want to know what all these mean, the hyperlink takes you there.

What is an annuity?

What is an annuity?

Most dictionaries define an ‘annuity’ as an investment or insurance policy that pays someone a fixed sum of money each year. We all know what annuity income means and if you did Latin at school (is that still a thing?), you’d recall that a year was an annus.

So, already things become a little complicated. The annuity that is most commonly known in South Africa is the retirement annuity (RA), being first on the list above. An RA does not in fact pay you any money annually but rather refers to an approved retirement savings product into which you need to deposit monies (usually monthly or annually) until you retire from this same product, whereupon you would then convert these funds into an income producing annuity. An RA is a very powerful investment medium, making tax work for you.

The second annuity on the list above is a life annuity. A life annuity is a product purchased from an insurance company by converting the capital proceeds of either a retirement annuity, pension or provident fund into a monthly income payment for the rest of your life. This retirement income (which can also be called a pension or an annuity) will never decrease regardless of what happens to investment markets or how long you live. Without a minimum guaranteed term, annuity payments will cease upon death, regardless of whether death occurs in the 1st or 20th year of receiving the annuity.

Non-profit life annuity

This type of life annuity provides you with a stipulated annual increase. The increase pattern is selected at inception. Called ‘non-profit’ life annuities because there is no participation in the profits of the underlying investments, you receive guaranteed initial income and a guaranteed future increase.

You can elect the annual increase, which may be linked to inflation or a fixed percentage (i.e. 5%). The key difference in this product is that the prescribed income is defined and guaranteed. The annuitant does not participate in any market performance, either on the up or down side.

With-profit life annuity

A with-profit annuity is a type of life annuity where your income can increase over time based on the investment performance of the underlying portfolio, typically a balanced fund. You participate in the “profits” of this portfolio through annual increases that the insurer declares.

When investment performance is good, your annuity income increases more. When investment performance is poor, your income will not decrease as the insurer bears the risk and provides this guarantee, but your increase may be smaller, or you might receive no increase at all for that year.

This structure provides protection against poor markets (no reductions in income), while still offering some incentive when markets perform well.

Enhanced life annuity

An enhanced life annuity is designed for retirees who are expected to have a shorter-than-average life expectancy due to health conditions, lifestyle factors, or other medical reasons.

The insurer assesses this through a process called underwriting, where – during quotation stage – health and lifestyle questions are raised to assess longevity. If the insurer determines that your life expectancy is shorter, you may qualify for a higher starting income than a healthy applicant of the same age with the same investment amount. Once set, this income is guaranteed for life, just like with a standard life annuity.

This ensures that individuals with reduced life expectancy receive fair value by enjoying a higher income upfront.

Voluntary purchase annuity

Distinct from all other annuities, which are referred to as compulsory purchase annuities (resulting from tax favourable contributions) is a voluntary purchase annuity. A compulsory purchase annuity must be procured using at least two-thirds of the benefits you receive from a retirement fund or pension fund.

Very differently, a voluntary purchase annuity can be bought from either the remaining one-third lump sum, or from discretionary savings, hence the term ‘voluntary’. Though not a tax-deductible investment, only the interest portion of income derived is taxable because it follows the principle that the money used to purchase the annuity has already been subject to tax elsewhere.

Careful planning for retirement involves understanding all your options, determining how your compulsory retirement savings dovetails with your voluntary savings and other investments, to meet your financial needs. Knowing one annuity product from another in amongst the ten different annuities already identified, is an integral starting point. Learning that there are ten different investment products in South Africa sharing the moniker of ‘annuity’ reaffirms the need to consult with a professional advisor. Be an informed investor, consult a professional and cut through the complicated world of Insurance jargon, clearing a path for an informed retirement planning future.

In summary, annuities can be:

- Compulsory or voluntary

- Can be both investment savings vehicles or income producing.

- Paid monthly, quarterly, or annually

- Guaranteed for a specific term, or not

- Included in your estate, or not

Compulsory purchase annuities: The retirement fund rule

When a member of a pension, provident, or retirement annuity fund reaches retirement, South African law requires that they use at least two-thirds of their retirement benefit to purchase a compulsory annuity. This annuity must pay out an income for the rest of the retiree’s life.

From here, retirees face several important decisions, including:

- Income frequency: Monthly is most common, but other options exist.

- Income level: Do you want the highest possible income now, or a variable one that allows investment growth?

- Beneficiary planning: Should income or capital pass on to a loved one if you pass away?

- Inflation protection: Do you want your income to increase over time?

- Investment choices: Would you prefer to select your own underlying assets or leave it to the insurer?

Structuring your annuity: What to consider

The decisions you make regarding your annuities will have long-term financial consequences on your lifestyle, legacy, and peace of mind. Consider the following:

- Do you want your income to remain constant, or increase over time to keep up with inflation?

- Would you prefer a guaranteed term (e.g., 10 years), after which no funds are paid to beneficiaries after your death, or would you like to ensure your family receives the remaining capital?

- Is flexibility important to you – such as choosing your investments or adjusting your income level over time?

These choices come with trade-offs. A higher income now may mean less future growth or lower or no benefits for loved ones after your passing. Conversely, a conservative income with room for investment growth may offer long-term sustainability.

Don’t forget beneficiaries

A critical part of annuity planning is understanding what happens when you pass away. Questions to ask your adviser include:

- Do I need to appoint a beneficiary?

- Will my beneficiaries inherit any capital?

- Can I assign the income to one person, and the capital to another?

- What happens if I pass away after the guarantee period?

A clear beneficiary plan ensures your wishes are respected and helps avoid unnecessary delays or disputes during estate settlement.

Key questions to ask your financial adviser

Before making any decisions, sit down with your financial adviser and explore the following:

- Is my annuity compulsory or voluntary?

- Can I insure more than one person under this annuity?

- Do I need a Living Annuity or a Term Certain Life Annuity?

- If applicable, what Term Certain options are available?

- What income level can I select?

- How often may I review or adjust this income level?

- What investment portfolios can I choose from? Do any offer guarantees?

- Who should I nominate as my beneficiary? Should I also appoint a secondary beneficiary?

- Will my beneficiaries or estate inherit any capital?

- Can I choose to direct income to one person and capital to another?

Choosing an annuity is not just a financial decision – it’s a life decision. With the right information and advice, you can confidently shape an income stream that supports your lifestyle, honours your legacy, and adapts to your evolving needs.

Take the time to explore your options. Speak openly with your financial adviser. Ask questions. Your retirement deserves nothing less than thoughtful planning and empowered decision-making.

Turning your retirement savings into a steady income isn’t as simple as it first sounds – but it doesn’t have to be confusing either. By understanding the basics and asking the right questions, you’ll be in a much better place to make a smart, confident decision.

Turning your retirement savings into a steady income isn’t as simple as it first sounds – but it doesn’t have to be confusing either. By understanding the basics and asking the right questions, you’ll be in a much better place to make a smart, confident decision.

It’s your future. Make sure you shape it your way. If you have questions about your retirement options or annuity planning, reach out to your financial adviser or our GTC team. We’re here to help you make informed choices – because your retirement should be something to look forward to, not worry about.