Adult conversations around the braai

Your wife and you are in your fifties. The family group consists of several grandparents, and a few teenage/adult children.

You’ve previously discussed the birds and the bees with the children, but round about now two different financial discussions are needed. Time to talk about the rands and sense?

Ah, family gatherings! The aroma of a Sunday braai, the lively chatter, the comfortable silences… and one big unspoken elephant in the room – your parents’ finances.

Ah, family gatherings! The aroma of a Sunday braai, the lively chatter, the comfortable silences… and one big unspoken elephant in the room – your parents’ finances.

It’s a topic often avoided with the same vigour as discussing politics at a birthday dinner. Parents often cling to their financial privacy like a prized antique, while adult children often feel awkward, not wanting to appear greedy or intrusive.

But let’s think about this – It isn’t about prying into the exact rand value of your folks’ nest egg. It’s about ensuring peace of mind for everyone, especially when life throws a curveball. Because, let’s face it, no one ever gets any younger, and eventually, someone will need to know where the financial skeletons (or, hopefully, treasures) are buried.

The uncomfortable truth: Why this talk matters

Imagine this – a crisis hits. A sudden illness, an accident, or, inevitably, the passing of a parent. Amid grief and emotional turmoil, those left behind are often left scrambling.

More than simply saying ‘where is the will?’ it’s often about related basic questions – which bank holds the accounts? Is there life insurance? What about that small business dad always talked about? Who to call (the financial advisor, the lawyer, the accountant)? and where are the key documents stored? And what about all those passwords? The lack of this basic information can turn an already difficult time into an administrative nightmare, often leading to unnecessary stress, delays, and even family disputes.

More than simply saying ‘where is the will?’ it’s often about related basic questions – which bank holds the accounts? Is there life insurance? What about that small business dad always talked about? Who to call (the financial advisor, the lawyer, the accountant)? and where are the key documents stored? And what about all those passwords? The lack of this basic information can turn an already difficult time into an administrative nightmare, often leading to unnecessary stress, delays, and even family disputes.

This isn’t about inheriting a fortune (though a pleasant surprise wouldn’t hurt, right?). Rather, it’s about sharing information between parents and adult children as an ongoing process prior to any unforeseen event. Many parents may have a knee-jerk reaction ‘It’s my money, my business!’ That seems reasonable as they have every right to their privacy regarding the exact amounts they possess. However, the critical distinction lies in disclosing the types of assets and liabilities, rather than the precise figures.

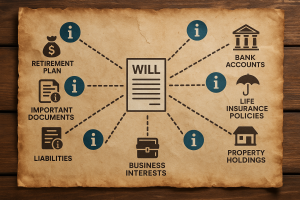

Think of it as giving you a map, not the treasure chest itself. This map should include:

Retirement plans – Are there pension funds, provident funds, or annuities? Which institutions hold them? Knowing this ensures these crucial long-term savings aren’t overlooked.

Investments – Do they have unit trusts, direct shares on the JSE or offshore, or perhaps other investments? Knowing the investment houses involved is key. Again, not the balance, but the existence.

Bank accounts – Which banks do they use? You don’t necessarily need account numbers or balances, just the names of the financial institutions. Alternative signatories also help with ensuring accounts aren’t blocked or inaccessible.

Trusts – Is there a family trust? – Who are the trustees? What is its purpose? Trusts are powerful tools for estate planning, but if their existence and structure aren’t known, they can become incredibly complex to manage.

Life insurance policies – are there any policies? – With which insurers? These can be vital for providing liquidity for immediate expenses or for beneficiaries.

Property holdings – Do they own their primary residence? Any holiday homes? Investment properties? Both locally and internationally?

Business interests – If they own a business, are they a sole proprietor, partner, or shareholder in a private company? What are the succession plans?

Significant liabilities – Mortgages, personal loans, business debts. Knowing about major debts is just as important as knowing about assets.

Key professionals – Who is their financial advisor, lawyer, accountant, or the executor of their will? Having their contact details can save immense time and stress.

Important documents – Where are the original wills, powers of attorney, medical directives, and other critical legal papers kept? Is there a fireproof safe, a lawyer’s office, or a secure digital vault?

It’s definitely a good idea to draft a summary document, detailing all the above and keeping it with other critical documents.

How to start the conversation

This ‘money talk’ doesn’t have to be a single, awkward interrogation. It can be a series of casual conversations. If initiated by the children, frame it around their well-being – ‘Mom, dad, we want to make sure your wishes are always respected, no matter what. Can we talk about where your important documents are and who we’d need to contact if something unexpected happened?’

This ‘money talk’ doesn’t have to be a single, awkward interrogation. It can be a series of casual conversations. If initiated by the children, frame it around their well-being – ‘Mom, dad, we want to make sure your wishes are always respected, no matter what. Can we talk about where your important documents are and who we’d need to contact if something unexpected happened?’

Focus on practicality ‘If you ever needed help managing things, where would we even start?’. It is also good to share your own plans (if appropriate), ‘I’ve just updated my will, and it got me thinking about how important it is for us all to have our affairs in order.‘

Suggest a professional – Offer to sit down with their financial advisor or lawyer. Professionals are experts at facilitating these discussions impartially.

Sadly common is the frequency of sophisticated cyber-crime following the (published) death of an elderly person. Surviving spouses are targets for unscrupulous criminals purporting to be bank officials, tax collectors, or estate executors. Banking and investments need to be protected by the adult children. Line-of-sight of these accounts by adult children is of vital importance.

When adult children are imminently responsible for the funding of retirement estate levies, Uber journeys, and the purchasing of groceries, it is only fair that intervention into parents banking is undertaken sooner rather than later. It’s also impossible to determine when parents will lose their financial facilities, but they will. Taking over their financial transacting before this happens (and before cyber criminals pinch it) is a non-negotiable.

The counterpoint (and perhaps more elephants?): Pushing the children towards financial adulthood

So, continuing the scenario where a couple has both aging parents, here this same couple also has children finishing their own schooling.

Flipping the script of the aging parents to children entering the job market – parents need to open up in their crucial role of dragging their newly graduated, first-job-holding offspring into the world of financial responsibility. Because, let’s be honest, that first pay-check often feels like a license to splurge, not to save.

You’ve taught them how to drive, how to do laundry, and maybe even how to cook a basic meal. But have you taught them about compound interest, disability cover, or the magic of a tax-free savings account? It’s never too soon to sit them down and explain that a portion of that hard-earned cash needs to go towards ‘adult stuff’. This isn’t about denying them fun but about securing their future. It’s always worth using a trusted financial planner.

You’ve taught them how to drive, how to do laundry, and maybe even how to cook a basic meal. But have you taught them about compound interest, disability cover, or the magic of a tax-free savings account? It’s never too soon to sit them down and explain that a portion of that hard-earned cash needs to go towards ‘adult stuff’. This isn’t about denying them fun but about securing their future. It’s always worth using a trusted financial planner.

A neutral third-party expert can explain the importance of:

Saving and Investing: Starting early, even with small amounts, can lead to a significant ‘nest egg’ over time through the power of compound growth.

Retirement planning: It sounds light-years away to a 22-year-old, but contributing to a retirement

annuity or pension fund from day one is a game-changer.

Emergency funds: The importance of having 3-6 months of living expenses saved for unexpected bumps in the road.

Disability protection: What happens if they can’t work due to illness or injury? Income protection and disability cover are crucial, even for young, healthy individuals.

Debt management: The perils of bad debt (and the benefits of good debt!)

Budgeting: How to manage their income and expenses effectively.

This isn’t about being a helicopter parent; it’s about being a financially responsible guide. Just as you prepared them for the world of school, tertiary studies and then work, prepare them for the world of wealth management. It’s a foundational lesson that will pay dividends (literally!) for the rest of their lives.

Ultimately, these conversations – both from parents to children and vice versa – are a gift of foresight and care. They’re about ensuring that when the time comes, your family can focus on supporting each other, rather than navigating a labyrinth of financial unknowns. So, next time you’re gathered around the braai, perhaps gently nudge both the potential elephants in the room. Your future selves will thank you for it.

Ultimately, these conversations – both from parents to children and vice versa – are a gift of foresight and care. They’re about ensuring that when the time comes, your family can focus on supporting each other, rather than navigating a labyrinth of financial unknowns. So, next time you’re gathered around the braai, perhaps gently nudge both the potential elephants in the room. Your future selves will thank you for it.