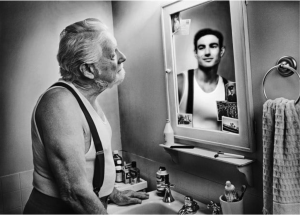

Financial advice I would give my twenty-year-old self

Reflecting on my journey from a modest childhood background to a comfortable retirement, here are key insights that I would give my younger self if he (or is it me?) was starting a financial journey now.

Early beginnings and career

Growing up in a large family (I was one of 10 children), financial stability wasn’t a given. I started my career with minimal income during military service, later qualifying as a Chartered Accountant. Marriage and children followed, prompting us to invest in a home, together with the conventional process of raising a family.

Do you start with your head, or your heart?

It’s all very well to pursue a prospective career based on ones prevailing interests. Choosing a qualification and career path that provide for realistic financial reward, rather than the idealistic pursuit of a life passion is a reality check. Bankers and game rangers do not earn the same. Make your choices wisely. A life passion when you are 18 might not prevail when you are 30 with children.

The changing financial landscape

Today’s young adults face a different financial landscape with advanced options like mobile banking, Exchange Traded Funds (ETFs), cryptocurrencies, and many other investment opportunities. Tailored financial planning is crucial, especially considering the plethora of investment options, diverse circumstances and specific family dynamics.

Essential factors in financial planning

Timing: Starting early is critical due to the compounding effect (while this advice would have been given to my grandfather by his dad – it remains as relevant today as one hundred years ago). Regular, long-term investments will consistently outperform market timed strategies.

Available funds: Despite the pain of initial financial constraints, early investments yield significant benefits over time.

Life stages: Financial responsibilities evolve with age. Early career demands differ from those closer to retirement, influencing savings and investment strategies.

Family planning: Long-term goals such as housing, education, and retirement require careful financial mapping. Flexibility and foresight are key.

Insurance and retirement: Life cover and retirement planning are vital. Starting early and supplementing employer funds will bridge retirement income gaps. A compulsory company retirement fund is never sufficient on its own.

Types of investments

A variety of investment vehicles cater for different risk appetites and financial goals, from retirement annuities to ETFs. Remember that risk profiles change over time. Use time to your advantage. Don’t be too conservative too soon, though reduce your risk profile the closer you get to your target date (remembering that ‘retirement’ is not a single date but a period of some 20-40 years).

Investment performance and costs

Higher-risk investments typically offer greater returns but entail fluctuations. These could also lose capital in some years, the 2007/8 crash being an excellent example. Consider investment costs, which impact overall returns. Low-cost options like ETFs can optimise investment efficiency.

Personal financial strategies

Each person’s financial planning is personal. There are a bunch of factors that will however prevail and be applicable anyway. These include:

- Mortgage management: Early repayment of mortgage bonds offers substantial savings and builds home equity. This is also tax efficient as the interest compounding on your mortgage is on your after-tax take home pay.

- Additional contributions: Utilise bonuses and discretionary income to boost retirement savings beyond mandatory contributions. Your company sponsored fund is not enough.

- Preservation of funds: When changing jobs, transferring retirement funds to preservation accounts avoids tax penalties and maximises growth. It also respects the fundamental principle of compounding growth.

- Family investments: Starting early with modest monthly contributions for children can fund future major expenses such as education, cars, and first homes.

Just as Baz Luhrmann in his song ‘Wear Sunscreen’ points out ‘Whereas the rest of my advice has no basis more reliable than my own meandering experience, I will dispense this advice now’, so too is this short write up my advice based on my own meandering experience. An experience that has resulted from a position of relative retirement comfort and many years of disciplined financial input.

Do’s and don’ts of financial planning

Do:

Start saving as early as possible – The earlier you begin, the better. Prioritise savings for all your financial needs, including retirement.

Plan for future expenses – Structure your financial plan around your expected costs, from homeownership to education and retirement.

Avoid credit card debt – Credit card interest is extremely high. If you use a credit card, treat it like a debit card and pay off the full balance monthly.

Pay off your mortgage early – Making extra payments on your bond can significantly reduce the loan term and save you money on interest.

Prioritise paying down expensive debt: Tackle high-interest debt first to minimise financial strain.

Be practical about car purchases: Cars depreciate quickly and come with high insurance costs. Choose a safe, reliable vehicle rather than an expensive status symbol.

Invest bonuses and windfalls wisely: Allocate extra income towards savings and investments to build long-term wealth.

Preserve retirement savings: When changing jobs, transfer your retirement funds to a preservation fund instead of cashing out.

Expect financial setbacks: Life happens. Have an emergency fund and remain adaptable to changes in your financial situation.

Seek professional advice: A financial planner can help optimise your savings, taxes, and estate planning.

Make a Will: Protect your dependents and ensure your wishes are carried out efficiently.

Don’t:

Don’t cash out your retirement savings early: Resigning to access your pension or provident fund is a costly mistake.

Don’t buy expensive cars just to “look good”: They depreciate rapidly and can strain your finances.

Don’t get trapped in credit card debt: High-interest rates can quickly spiral out of control.

Don’t spend on luxury items before financial stability: Expensive “toys” should only come after achieving financial security.

Financial protection

Life insurance: This is essential if you have dependents. Choose policies that balance coverage and affordability.

Estate planning: Draft a will to protect your assets and ensure a smooth transition for your dependents.

Final thoughts

Financial stability and retirement comfort are achievable only through disciplined planning and informed decisions. Avoid shortcuts, prioritise long-term goals, and embrace professional guidance for a secure financial future.

And always remember to ‘wear sunscreen’.

Note from the CEO editor: Whilst GTC shares many of the opinions passed, this is a client’s article.

We invite you to discuss this with either your GTC retirement benefit consultant or one of the GTC MAPS team.