Semigration

David Seligman

David Seligman

Fund Manager

_______________________________________________________________________________________________________

Semigration: Would you bet the house on it?

Perhaps a uniquely South African word, semigration has been both a noun and a verb in South Africa for the past ten years or more. The already established trend whereby retirees move from the economic hub in the centre of the country to coastal locations, favouring lifestyle over economic activity, has gained momentum and intensity with more economically active South Africans (actively supported by the work-from-home permissions of the Covid-19 years) choosing to move from one urban area to another.

Perhaps a uniquely South African word, semigration has been both a noun and a verb in South Africa for the past ten years or more. The already established trend whereby retirees move from the economic hub in the centre of the country to coastal locations, favouring lifestyle over economic activity, has gained momentum and intensity with more economically active South Africans (actively supported by the work-from-home permissions of the Covid-19 years) choosing to move from one urban area to another.

Nowhere is this more clear that the move of economically active South Africans from various locations to the Western Cape. This migratory trend is also in sharp contrast to the historical trend of rural populations moving into South Africa’s economic hub.

The economic impact of semigration is compounded by the fact that it seems to be led by those who have the most financial influence and consequence. While difficult to quantify empirically with little census data readily available, the relocation of higher net worth individuals (HNWI’s) and families from Gauteng to the Western Cape is a definite trend.

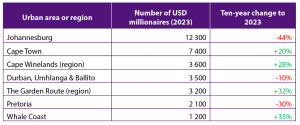

Cape Town based international consultancy, Henley and Partners have estimated the number of US Dollar millionaires per city and the percentage change over the past 10 years to 2023 in seven South African urban areas, according to their African Wealth Report 2024.

According to their research?, Gauteng has lost around 10,500 USD millionaires in the last 10 years (clearly not all to semigration), while the Western Cape now has more USD millionaires than Gauteng. It is also true that the Western Cape is an increasingly popular retirement destination for migrating millionaires from Europe and the rest of Africa.

As to why people move from Gauteng to the Western Cape – the two most cited reasons are concerns around Gauteng infrastructure as compared with that of the Cape (particularly water, electricity and roads) and the perception that the Cape offers a better lifestyle and quality of life than Gauteng.

Another reason for moving to the Cape frequently cited is the anticipated economic growth of the region, particularly when compared with Gauteng’s own expectations. As the Cape likely grows wealthier, there are anticipations of increased business opportunities and trade flows in the region. As an example, based on ACSA’s passenger statistics of March 2024, a record 2.75 million international passengers passed through Cape Town International Airport last year, surpassing the previous high of 2.4 million set pre-Covid, in 2018. While OR Tambo in Johannesburg still had 7 million international arrivals for the equivalent period, this represents 2 million less passengers than the 9.2 million from 2018.

For people considering semigration, there are (or should be) a few concerns:

- How will the Western Cape cope with the rapid influx of migrants and what strain will be placed on municipal services? For example, traffic in certain parts of Cape Town is already gridlocked for many hours of the day.

- Many semigrants are in their later working years or approaching retirement and this may place strain on existing health infrastructure.

- The most important concern for many potential semigrants is the disparity between house prices in Gauteng and the Cape.

Based on information from the Stats SA report on ‘Residential Property Price Index 03/2023 from 2010 to 2022’, Cape Town house prices increased by 141% (7% annualised) compared to just 71% (4.2% annualised) for Johannesburg and an average of 98% across all metros. As a result of the moribund growth in property prices in Johannesburg, many aspiring semigrants have found that they cannot replace their homes on a like-for-like basis.

Based on information from the Stats SA report on ‘Residential Property Price Index 03/2023 from 2010 to 2022’, Cape Town house prices increased by 141% (7% annualised) compared to just 71% (4.2% annualised) for Johannesburg and an average of 98% across all metros. As a result of the moribund growth in property prices in Johannesburg, many aspiring semigrants have found that they cannot replace their homes on a like-for-like basis.

Some Cape house prices in the more desirable suburbs and towns have increased substantially more than the average 141% since 2010.

A significant contributing factor to Cape Town’s property price increases in certain areas is surely that, Cape Town now has more than 20 500 Airbnb listings, with many hosts having multiple listings, with five hosts having over 100 listings each! This is according to Airbnb’s own data as sourced from SA data site The Outlier.

Semigrants who want to maintain their standard of accommodation often must supplement the proceeds of their exiting house sale with capital from other assets, such as investments. This is often problematic for several reasons. The homeowners, who are dependent on a finite capital amount for their entire lifestyle provisions, concentrate an increased percentage of their capital into a single investment, whilst reducing other investment requirements (which could include medical and recreational allocations) into housing.

Capital value increases in houses in the Cape, while admittedly better than in Gauteng, have averaged around 7% per annum, which is certainly ‘not shooting the lights out’ when compared to equity returns. Unless a portion of the home is rented out, there will be no income realised on this investment.

Another option for semigrants that could be considered is renting a property instead of buying. To make this decision some understanding of gross and net rental yields is required. A gross rental yield is simply the gross income received per annum divided by the cost of the investment.

For Cape Town, current gross rental yields average 7.9% per annum. Ironically in Johannesburg, due to lower capital values, rental yields average 11.6%, according to the Global Property Guide’s report on ‘Gross rental yields in South Africa: Cape Town and five other cities 03/2024’.

Net rental yield, a more comprehensive and complex formula is more accurate, as this looks at the percentage return after owner’s other costs, such as levies, rates and taxes, agents’ fees and maintenance. This can reduce gross yield by two or more percent, so that the net return would be well below 5%. A net rental yield of this quantum may well imply that there could be significant opportunity costs in buying a property, with this same capital perhaps better invested elsewhere and diversified across other asset classes and geographical regions.

Data sourced from Lightstone, an internationally recognised real estate data business, suggests that 80% of South African semigrants purchase a property of greater value than that which they’ve just sold, with 58% of those buying a smaller property than they sold. Suffice to say that doing one’s homework when considering semigration (or indeed any property move) is imperative.

Data sourced from Lightstone, an internationally recognised real estate data business, suggests that 80% of South African semigrants purchase a property of greater value than that which they’ve just sold, with 58% of those buying a smaller property than they sold. Suffice to say that doing one’s homework when considering semigration (or indeed any property move) is imperative.

Chat to one of GTC’s experienced advisors, carefully examining the opportunity costs and risks involved in buying versus renting.