Market Overview – Second quarter 2024

In-depth market commentary – Ready, set… GNU

Over the quarter the world continued to grapple with lofty global US Tech valuations, stubborn inflation, incessant conflict in the Middle East, and a somewhat deteriorating geo-political outlook. At home, we took to the polls to cast our ballot for a better South Africa. Resulting from this election was an improved functioning cabinet that emerged from the ANC’s clunky attempt to remain in the driving seat of South Africa’s government, albeit with nine passenger parties now.

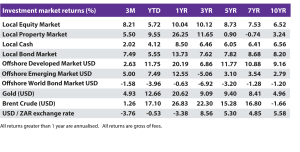

Over the quarter:

- Local equities ended the quarter up +8.2%, well ahead of Developed Market Equity and Emerging Market Equity indices. The month of June alone reported a +4.2% gain as investor sentiment turned positive on the back of the South African election results.

- While the Resources and Industrials sectors drove much of the positive equity market return in the first two months of the quarter, the Financials sector rallied +14.5% in June to end the quarter up +17.1%. Subdued global commodity prices along with a stronger rand, weighed down rand hedged and commodity-focused stocks. The Industrials sector closed the quarter up +5.2% with the Resources sector up +3.5%. Much of the Listed Property sector’s gain was earned in June (+5.9%), as the sector closed the quarter up +5.5%.

- Local investment markets appear optimistic about changes to come from South Africa’s Government of National Unity (GNU), however, the size of the cabinet – 32 ministers with 43 deputy ministers – and its ability to work together remains a headwind.

- South African headline inflation (CPI) increased marginally to +5.6% in February 2024. While this level is within the SARB’s target range (3% – 6%), it by no means dissolves inflation concerns as global trade and energy challenges remain a headwind.

- Improved sentiment spurred a rally in bond purchases from both local and foreign investors, propelling the local bond market to outperform local equities over the month of June and end the quarter (+7.5%) ahead of local cash (+2%). The South African Reserve Bank (SARB) kept interest rates unchanged at +8.25% over the quarter despite headline inflation (CPI) coming in slighter cooler at +5.2%.

- The US Fed met twice over the quarter and in both cases left the interest rate unchanged at 5.25%. The Bank of England also maintained its rate at +5.25% during its June meeting while the European Central Bank cut interest rates by 25 basis points to +4.25%, as widely expected, with inflation cooling to +2.5%.

- The Emerging Market Equity index (+5.0% USD) outperformed the Developed Market Equity index (+2.6% USD) over the quarter, following the conclusion of India’s election and overall positive turn in emerging market sentiment. The Developed Market Equity index remains increasingly concentrated towards the US and a select subset of stocks that account for more than half of the index’s return. The rand strengthened +3.8% against the greenback over the quarter detracting from rand-denominated offshore market returns.

- Overall, global investor sentiment was mixed over the quarter. While the short-term outlook is still unclear, the longer-term picture remains positive.

Amid these global challenges, GTC remains cautiously optimistic about the future outlook of investment markets. We reiterate our stance that patience, especially through periods of difficult investment performances, afford markets the time needed to filter out what is relevant from the noise. It allows market drivers the required time to achieve a new state of normalcy and portfolios the time needed to compound growth on growth.

Though the investment road may be bumpy, GTC has designed its solutions to hedge out much of the inherent investment risk while still positioning the portfolio for the highest probability of delivering on its investment objectives. It is crucial to stay invested in line with investment objectives when trying to achieve one’s financial goals, and not be swayed by short-term sentiment.