Asset Management – Compounding interest

Samir Narotam

Samir Narotam

Portfolio Manager

_______________________________________________________________________________________________________

Money that multiplies: The power of compounding interest

What is the ‘compounding effect’ and how does it work in one’s investment portfolio?

Compounding is the process of earning returns on your past returns. It’s one of the most powerful tools in investing, and it can help your investment grow exponentially over time.

Taking an analogy from the Oracle of Omaha – Warren Buffet, think of a snowball rolling down a hill, and with each rotation, it picks up snow and grows. The larger the snowball, the more snow it accumulates for each rotation and the longer the hill, the more time it has to grow. To understand the intricacies of compounding, it is helpful to start with a simple example:

Imagine that you invest R1 000 in a five-year, 5% fixed deposit account that pays interest annually. In each of the five years, you will earn R50 in interest and will receive a total return payout of R250 at the end of the period with a remaining account balance of R1 000. Your return each year is based only on your initial R1 000 investment through a calculation better known as simple interest.

Now imagine that you invest your R1 000 in a five-year, 5% fixed deposit account in which you reinvest your interest instead of taking an annual payout. In the first year, you will again earn R50 in interest, however by reinvesting it, your total balance will grow to R1 050. In the second year, you will now earn interest on both your original investment of R1 000 and the interest you earned in the first year of R50. This means that you will earn a total R52.50 in interest in the second year, and your account balance will grow to R1 102.50. This process continues to repeat for each of the remaining years in which you earn interest on interest allowing your portfolio to grow exponentially to a total of R1 276.30. This is known as compound interest.

In effect, your investment would earn a cumulative 11% more in interest through compound interest than through simple interest. While simple interest does give you access to a regular cash payout, it comes at the expense of lower growth over time.

The true power of compound interest, and why it has been referred to as the eighth wonder of the world, is better understood when viewed over a longer period.

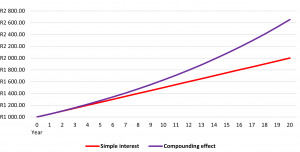

Exponential growth over 20 years due to the compounding effect

If we extend the time period of both investment accounts considered above to 20 years, your R1 000 investment would have grown an extra R653 (+33%) due to the effect of compounding compared to the non-compounded return i.e., simple interest.

While compound interest clearly offers significantly higher growth when one stays invested for a long period and earnings or dividends are reinvested, this can be even further amplified if one also contributes additional capital on a regular basis.

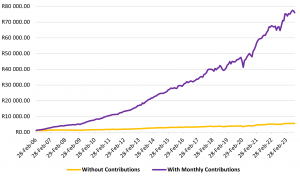

The example below considers a real-life R1 000 lumpsum invested into a moderately aggressive GTC portfolio, with an inception some 18 years ago. A monthly contribution of R100, being 10% of the lump sum, was undertaken. This monthly contribution increased by 5% annually. On the after-fee basis, the compounded R1 000 investment would have yielded R5 480 after the 18-year period if it had not had any additional contributions (orange line). While impressive (considering the initial consideration of R1 000), this theoretical return is dwarfed by the R75 900 portfolio value (purple line) which was achieved through the regular contribution of the R100 per month, with the 5% escalation per year. This resulted in a total capital appreciation of R42 900.

Impact of regular contributions with compounded returns

Returns used reflect the actual investment strategy returns of GTC’s moderately aggressive strategy after fees. Past performance is not a guarantee of future performance.

The above chart illustrates that ambitious long-term financial goals are possible if we follow simple guidelines that can maximise our investments such as:

- Start early: Compounding is most effective over the long term. The longer your money is invested, the more time it has to grow.

- Reinvesting earnings: Reinvesting your earnings is the best way to accelerate the growth of your portfolio.

- Invest regularly: Even if you can only invest a small amount each month, it will add up over time and increase the exponential growth of your investment.

Conclusion

Much like the snowball increasing in size as it rolls down the hill, compound interest can help your money grow exponentially over time and is key to achieving long-term financial goals. Earning interest on your interest means that your earnings are growing at an ever-increasing rate. By starting early, investing regularly, and choosing the right GTC investment, you can maximise the power of compounding in your investment portfolio. We don’t have to be Einstein’s to benefit from the world’s eighth wonder.