Wealth Management – Capital appreciation to income generation

Jenny Williams

Senior Servicing Consultant

_______________________________________________________

Considerations of a long-term well-structured retirement portfolio – Part 3

Navigating retirement planning: Shifting focus from capital appreciation to income generation

Last quarter we analysed the difference between pre – and post – retirement portfolio construction and some investment errors we frequently come across. In this, our third and final article on structuring retirement portfolios, we focus on the appropriate revision of a retirement portfolio once its objective changes from providing capital accumulation to regular income drawdowns.

A typical financial journey will take you through various stages beginning with accumulation and (almost always) ending with spending. Because of this, the investment strategy adopted must change. Retirement date (and for the purpose of this article, this is defined as when you stop drawing a salary from an employer) necessitates a crucial shift in perspective and a commensurate revision of your retirement portfolio. Your primary objective changes from capital appreciation to income generation. However, it is not that simple. Retiring at (say) 65 requires that you plan to replace some portion of your salary with income from your own portfolio. You do, however, still need to plan to continue accumulating growth on some portion of your other assets to provide for income in future years. You may recall a previous Trendline article about age expectations?

Do I have to change my portfolio construction at retirement?

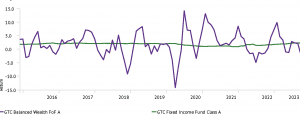

An investor is quite entitled to drawdown on a capital accumulation-based (say) unit trust (such as an equity-weighted portfolio) whenever they want to. The proceeds of this can of course be used to pay for whatever the investor wants. Why then not use this same portfolio that was used for accumulating wealth, for the subsequent requirement of paying for things? The graph below answers this.

Comparing a capital accumulation portfolio with a fixed income portfolio

The Balanced Wealth Fund, by its very nature, is volatile in its progressive returns. Extreme luck would be required to redeem only when the fund value was high. In reality, an investor would sometimes be selling at an inopportune time.

The Fixed Income Fund, on the other hand, has a far more predictable and incremental return characteristic, and regular withdrawals are always appropriately timed.

Rethinking your portfolio allocation

To shift your portfolio’s objective from capital appreciation to income generation, you’ll need to make some strategic changes. Here are some key steps to consider:

Embrace income-generating assets: Start by allocating a portion of your portfolio to income-generating assets. Bonds, dividend-paying stocks, property stocks (including real estate investment trusts (REITs)), and fixed deposits can provide regular stable income. These assets have lower volatility compared to growth stocks, making them more suitable for income generating assets.

Diversify for stability: Regardless as to whether one is planning a portfolio for growth or income, diversification remains a cornerstone of successful investing. By spreading your investments across various asset classes, and by various underlying investments even within the same asset class, you will reduce risk and increase the stability of both your growth and income stream.

Consider annuities: Annuities are a popular choice for generating retirement income. An annuity is a financial product that provides regular payments in exchange for a lump sum or periodic contributions. Annuities can offer peace of mind by guaranteeing a steady income for life. A caution here as there are many different types of annuities with different legal and tax consequences.

Understanding the difference between constructing a risk-adjusted growth portfolio and creating income

GTC would advise against using short-term risk-reducing strategies (such as moving reactively into a cash portfolio) as alternative investments to equities. Revising a portfolio’s objective to provide for the short-term income requirements should be a considered and long-term strategy.

GTC recommends using an ‘income filter’. This is usually a portfolio of fixed income and other secure investments that have little risk of capital losses.

Units are sold to provide the investor with money in the bank. This income filter is usually structured to provide for several years of drawdowns.

As was noted right up front, an investor’s unique risk appetite and propensity for volatility will shape a portfolio construction. Far from being a subjective view (it can’t simply be a question of ‘how much risk do you want to take?’), this must be professionally assessed and applied accordingly.

An accurate risk assessment will contribute to the correct strategic asset allocation (i.e., long-term planning) of one’s portfolio. Rebalancing the portfolio as regards the mix of income and capital growth needs to happen on an ongoing, rolling basis notwithstanding the initial (say) four-year provision. The higher the assessed risk profile (including years of income required, age, tolerance for market volatility, etc.), the higher the equity allocation in the portfolio should be.

GTC offers various risk-profiled portfolios pairing envisaged outcomes and risk profiles. These portfolios are structured such that the assessed risk profile and income requirements are continuously aligned. Government regulations stipulate the asset allocation of these portfolios. You can read more about Regulation 28 of the Pension Funds Act here. You can watch our video on this subject here.

We’ve written about it in previous Trendline publications, and we remain very proud of GTC’s bespoke TrueNorth financial planning tool. You can read about this again here. TrueNorth provides an in-depth objective, actuarially derived assessment of your own affairs and – together with a GTC advisor – makes appropriate recommendations, not just on asset allocation but on many other aspects of your financial planning such as tax planning, and estate duty minimising strategies.

Regularly review and adjust: Particularly as you approach retirement, it’s crucial to regularly review and adjust your portfolio. Market conditions change, and your financial needs will be evolving. Periodic reassessment ensures that your investments align with your retirement objectives.

Keep an emergency fund: Even in retirement, having an emergency fund is essential. It can help cover unexpected expenses without having to dip into your income-generating assets. This emergency fund should never be compromised by prevailing negative market conditions.

Tax considerations

Tax efficiency is a significant factor when transitioning from capital appreciation to income generation. Different investment products and strategies have different tax implications. Consult with a financial advisor who understands the relevant tax laws to optimise your retirement income and minimise tax liabilities.

The role of a professional financial advisor

Navigating the transition from capital appreciation to income generation in your retirement portfolio is complex. This article does little more than slightly lift the lid of a very dark box. Regardless of your investment competence, recognising that retirement fund construction requires some in-depth legal and tax knowledge, as well as investment prowess, the guidance of a professional financial advisor who specialises in retirement planning and who can help you create a tailored strategy that aligns with your goals, risk tolerance, and time horizon, is strongly recommended.

By diversifying your portfolio, exploring income-generating assets, and seeking professional guidance, you can confidently transition into retirement with the peace of mind you deserve.

If you have any questions or require personalised guidance on adjusting your investment portfolio, please reach out to our team. GTC is here to support you on your path to a financially secure retirement.