Healthcare Consulting – Medical aid premiums 2024

Jillian Larkan

Jillian Larkan

Head – Healthcare Consulting

_______________________________________________________________________________________________________

Navigating the 2024 medical aid landscape: Balancing health and finance

September of each year marks the beginning of the medical aid premium announcements for the next year. These have historically been concluded by the end of each October. As medical aid premiums – more than any other household expense, other than perhaps electricity – routinely increase by more than CPI, many South African consumers are understandably anxious about budgeting for the funding of their 2024 healthcare premiums.

September of each year marks the beginning of the medical aid premium announcements for the next year. These have historically been concluded by the end of each October. As medical aid premiums – more than any other household expense, other than perhaps electricity – routinely increase by more than CPI, many South African consumers are understandably anxious about budgeting for the funding of their 2024 healthcare premiums.

This year, the Council for Medical Schemes (CMS) issued guidance, urging medical aid providers to keep their increases within a range of ‘5% plus reasonable utilisation estimates’ in the fairly technical

12-page Circular 27 of 2023 entitled: ‘Guidance on contribution increases and benefits changes for 2024’. In summary, Mr Mfana Maswanganyi – the Executive responsible for regulation within CMS, made the following points:

Understanding utilisation estimates

Special mention was made of ‘utilisation estimates’. This is a key factor in determining medical aid premium increases and refers to members’ usage patterns concerning medical services. These patterns were significantly affected by the Covid-19 pandemic, though they are now gradually returning to pre-pandemic levels. CMS has encouraged medical schemes to base their utilisation rate calculations on pre-pandemic data, the specific profile of their schemes, and their actual client usage data.

The table below, extracted from the circular, indicates the assumed utilisation numbers over the years:

Economic factors at play

The CMS is acutely aware of the global and local economic landscape and its impact on the medical scheme industry. It highlights several key factors, including the Russia-Ukraine conflict, potential technical recessions in the Americas, and domestic challenges including load-shedding, high interest rates, depreciating exchange rates and unemployment statistics. The CMS anticipates that these factors will intensify the financial strain on households, advising medical aid providers to limit their increases as much as possible.

Historical trends and challenges

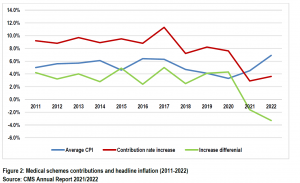

GTC notes that when analysing historical data, it becomes evident that annual medical aid increases have consistently outpaced both the CMS-recommended rates and CPI, with only the Covid-19 years of 2021 and 2022 being exceptions.

A closer look at the numbers

The table below, extracted from the circular, illustrates that the annual ‘increases above inflation’ are consistently in a band of between 2% and 5% above CPI for nine of the eleven years. While medical aid providers go to great lengths justifying their annual increases, the CMS recognises that certain factors, unique to the industry – such as the burden of diseases, demographic profiles, and the impact of a weakened rand exchange rate – may necessitate increases beyond CPI.

What to expect for 2024

Based on these metrics and recommendation tables, GTC anticipates that medical aid premium increases for 2024 will likely fall within the range of 7.4% to 10.4%, once again surpassing the prevailing inflation rate of some 4.8%, and, once again, above the proposed CMS increase of 5% plus reasonable utilisation. At the time of publication four schemes had already released their numbers for 2024, with these ranging from 6.9% to 10.8% for 2024.

Conclusion

Based on all available data, including the CMS circular, GTC sees the 2024 medical aid landscape as being challenging for consumers. Balancing health and financial well-being will be crucial, in the context of yet another anticipated medical aid premium rise considerably above CPI. Understanding the factors at play, including those highlighted in the CMS circular, such as utilisation estimates and economic conditions, will empower medical aid members to make informed healthcare decisions and prepare for potential budgetary adjustments.

GTC continually assesses all contributing factors which influence the wealth creation and financial planning of our clients, publishing relevant articles on the state of healthcare in South Africa as and when this is justified.

Visit our newsroom for previous healthcare related articles and media interviews.