Market Overview – Second quarter 2023

In-depth market commentary and the Magnificent Eight

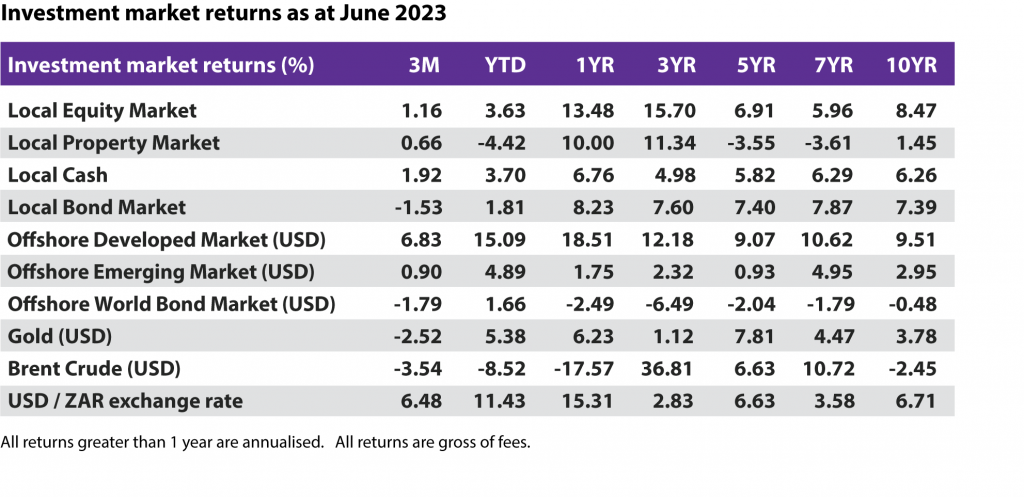

The quarter ending June 2023 has continued to reflect a challenging global investment market backdrop. Considerable market volatility and uncertainty have endured amid subdued global trade expectations and recessionary fears. Given their concerns about longer-lasting inflation, increasingly restrictive monetary policies from global central banks have kept markets on an uneven footing. All this necessitates continued caution in portfolio positioning.

Over the quarter:

- Much of the uncertain market rhetoric since the start of the year has been masked by the share price gain of a few global technology companies primarily linked to the artificial intelligence space. These shares represent a large weighting within global developed market indices and almost fully account for the entirety of the positive dollar-based performance delivered by the S&P500 index over the half year. The collection of these ‘Magnificent Eight’ stocks has risen nearly 60% for the half year whereas the S&P500 index excluding them is up less than 5% over the same period.

- International developed equity markets had a relatively strong quarter, earning +6.8%, well ahead of emerging markets which earned 0.9% in USD terms. The USD strengthened by +6.5% relative to the ZAR which further provided a tailwind for offshore assets’ return over the quarter when converted into rands.

- The upward rally over June 2023 pulled the local equity market’s performance for both the quarter (+1.2%) and half year (+3.6%) back into positive territory. This was primarily attributed to the +11.4% rally by the local financial sector over the month and the 6.0% return over the quarter after the sector’s sell-off during the first quarter of 2023.

- The local industrials sector gained +3.4% over the quarter while the local resource sector shed -6.4% amid softer precious metal prices and global trade uncertainty. The local property sector was mostly flat at +0.7% over the quarter.

- Over the quarter, the South African Reserve Bank (SARB) raised interest rates by +0.5% taking the repo rate to +8.25%. This represents an overall +1.25% interest rate hike since the start of 2023 in their efforts to reduce inflation.

- South African headline inflation (CPI) peaked in July 2022 at 7.8% and slowed to 6.3% in May. The continued disinflation provides some comfort that we might soon be within the SARB’s target range (3% – 6%).

- On a similar note, US headline inflation came in at 4% for the year ended May 2023 while the European Central Bank (ECB) continues to battle CPI at 6.1%. In response to elevated inflation, the US FED hiked interest rates by 0.25% to 5.25% over the 3 months while the ECB increased rates by a total of 0.5% to 4.0%.

- The local bond market (ALBI) delivered -1.5% for the quarter behind local cash (STEFI) at +1.9%. While the average yield of the South African bonds index came off in June with a corresponding +4.6% price gain, it was not enough to offset the sell-off experienced in the first two months of the quarter amid allegations that South Africa supplied Russia with weapons.

- Overall, global investor sentiment was mixed over the quarter. While the short-term outlook is still unclear, the longer-time picture remains positive.

In previous market commentaries, we have spoken of the old adage ‘It’s not about timing the market but rather the time in the market that matters’. The wisdom of this continues to hold true. Patience, especially through periods of difficult investment performances, affords markets the time needed to filter out what is relevant from the noise. Whilst a myriad of global factors continues to threaten a further protracted economic and investment market recovery, we maintain that staying invested in line with one’s investment objective is crucial to achieving one’s financial goals.