Market Overview

The first half of the year has been marked by historic sell-off’s in global investment markets.

-

-

2022 has so far been the worst 6 months on record for developed markets (MSCI World) since 1970. While local equities have held up comparatively well over this period, June’s performance has been the largest detraction since the March 2020 sell-off. This illustrates the sheer scale of the market volatility and uncertainty which afflicts investors currently.

-

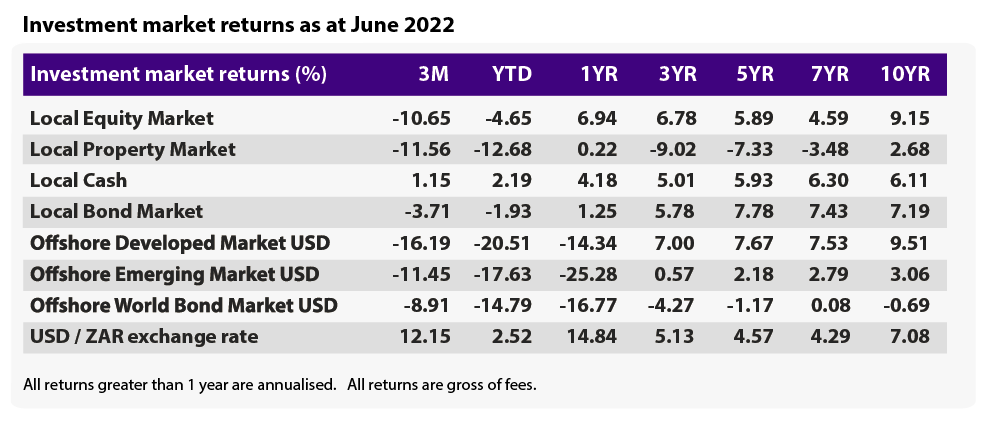

Global developed equity markets retracted some -16.2% over the quarter and -20.5% for the year in USD terms, while emerging markets experienced an -11.5% and -17.6% sell-off over the same periods in USD terms.

-

The negative returns derived from equity markets can be in part attributed to the increasingly hawkish stance of central banks and their concerns of deepening inflation along with Russia’s invasion of Ukraine, elevated transport costs, Europe’s energy crisis, and overall sluggish global economic growth expectations.

-

Whilst supply concerns in the first quarter provided significant upward pressure on the Brent Crude price – oil rising well over $130/barrel – recession fears over the second quarter pulled the price down drastically to $100/barrel on some days.

-

The local equity market (-4.7%), outperformed developed and emerging markets in both base currency and rand terms over the year. Through the quarter, the local equity market (-10.7%) outperformed both of these global peers in base currency terms.

-

Financials (+1.4%) have been the only positive returning local equity sector over the year, having weathered the risk-off sentiment better than all other sectors. Industrials have been the worst performing sector over the year but courtesy of the Naspers/Prosus rally late in June, it’s been the best performing sector over the recent quarter.

-

Global recession concerns, amid elevated inflation levels, have stifled resource demand expectations pulling the sector down -21.9% over the quarter.

-

The 12.2% rand weakness over the quarter meaningfully benefitted those South African shares with predominantly foreign earnings (rand hedge shares) relative to shares with predominantly local earnings.

-

Considerable volatility persists in the local property sector which sold off some -11.5% over the quarter. The outlook for local property remains uncertain amid a shift in property dynamics and demand along with the impact of the Russia-Ukraine war on the eastern European property sector.

-

Global inflation signals persisted as demand continued to collide with supply shortages across the world.

It is likely that inflation will abate to some extent in 2023, as we expect supply-side disruptions to be reduced. -

Distressing inflation rates have kept bond yields elevated and further intensified concerns around the degree of interest rate hikes and restrictive monetary policy decisions that central banks may implement.

-

The South African Reserve Bank (SARB) raised the repo rate by 0.50% to 4.75% in May as widely expected. May inflation (CPI) in South Africa breached the top end of SARB’s target range (3% – 6%) coming in at 6.5%.

-

The local bond market (ALBI) delivered -3.7% for the quarter behind local cash (STEFI) +1.2%, as increased bond yields pulled longer duration bond prices down.

-

As the old adage goes: ‘it’s not about timing the market but rather time in the markets that matters.” Selling when markets are down, locks in losses, whereas staying invested allows your portfolio to not only recover losses, but also gain when markets rally. This concept is further unpacked in the recent market update publication which can be found here.